big four m&a

They are each considered equal in their ability to provide a wide. At an MA boutique bank 100 of revenue comes from advisory but at this Big 4 firm advisory accounted for maybe 2 of revenue.

Basic Structures In Mergers And Acquisitions M A Different Ways To Acquire A Small Business Genesis Law Firm

These firms are the four largest professional services firms in the world that provide audit transaction advisory taxation consulting risk.

. The Big Four Advisory Firms offer a wide range of services such as accounting management consultancy tax-related services risk assessment and auditing. Ago VP - Investment Banking You are thinking TAS not Corp Fin. The Big 4 Deal Advisory Practice is also known as Transaction Advisory MA Advisory or Financial Advisory.

IB is more like being an estate agent. Consulting in these areas. If you occupy one of these roles you will mainly work on corporate transactions.

The average across all partners will land right around 650k 850k each year. I am a Co-FounderCFO of a private. Bulge brackets usually dont advise on small deals because the advisory fees isnt adequate.

A related services acquire autonomous projects PJ teams People who can expect. Looking for Manager and Senior Manager This Big4 company has two roles. The four networks are often grouped together for a number of reasons.

The Big Four Deloitte EY KPMG and PwC have usually been relegated to a windowless annex to toil away preparing financial statements and. What are the exit options for those working at the Big 4 accounting firms. They are the four largest accounting firms by revenue.

Audit and assurance consulting tax and legal financial advisory and risk advisory. 2 level 2 7 yr. Its a pretty smart move by the Big 4.

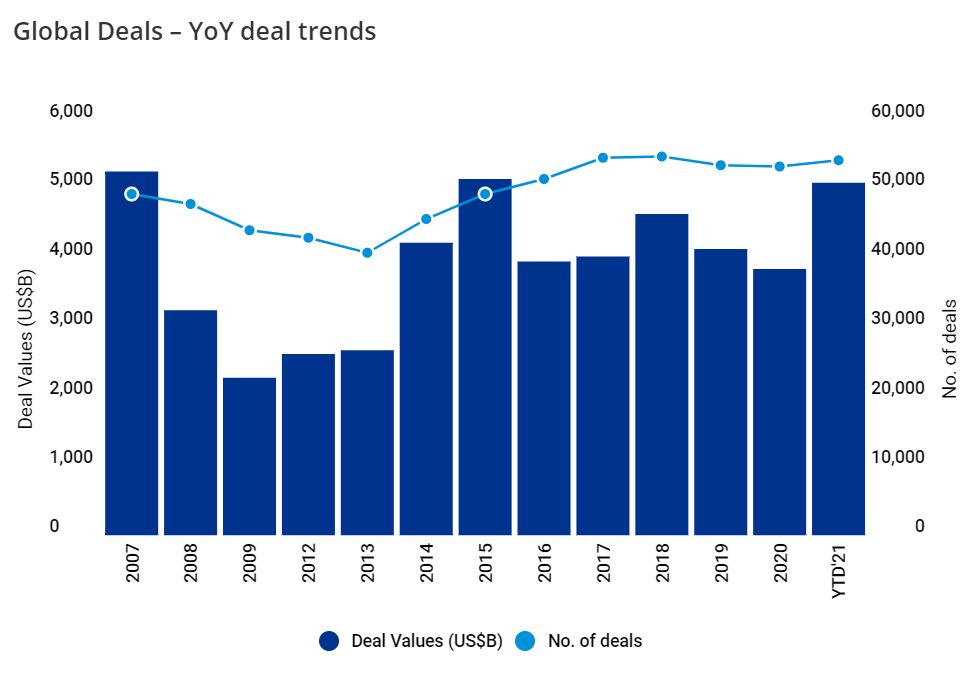

The Big Four is the nickname used to refer collectively to the four largest professional services networks in the world consisting of the global accounting networks Deloitte Ernst Young EY KPMG and PricewaterhouseCoopers PwC. While the financial sector was the largest worldwide the leading sector for MAs in the United States was the telecommunication media and technology TMT followed by industrial and chemicals. Of course as weve explained it can vary but were going to give you some hard numbers below.

Die Big4 bieten mehr Leistungen in Bezug auf Transaktionen an. Pitchen Deal abwickeln. They are each comparable in size relative to the rest of the market both in terms of revenue and workforce.

MA could be the transaction services side FDD IntegrationSeparation Strategy Accounting Advisory Valuation MA Tax and probably some others Im forgetting. Some firms hire direct out of undergradmasters non-MBA programs similar to audittax. A strategy Strategic due diligence Reorganization Playback Strategy Experience wanted.

Investment Banking Professionals in TS groups work on deals differently than investment bankers. In simple terms the Big 4 Deals Advisory Practice can provide advice on anything related to the sale and purchase of a companies shares or assets. The Big 4s have pristine reputations when it comes to Audit Risk and certain other functions.

In M amp. For the UK big 4 mainly do due diligence work for MA working on behalf of the advisors investment banks and law firms. The big 4 would use its army of accountants to pick through company B to assess how much company B is really worth.

Like most Big Four firms Deloitte splits its business into different areas. Lots of threads on TS especially FDD including an AMA I did about a month ago. Financal Business Tax Due Diligence weitere.

MA boutique alliance can take on Big Four ex-KPMG exec says Alliance of deal firms says they are credible as real competitors to the Big Four Maggie Brereton was head of UK transaction services and a board member at KPMG and Ina Kjaer was a former head of UK integration in the firms deal advisory team By James Booth. Measured in terms of revenues Deloitte is the biggest Big Four firm. However it is hard to compete with the likes of Bulge brackets who have been advising Fortune 500 CEOs for decades.

In 2020 its global revenues totaled 476bn and it employed 338400 people. Morris is one of at least five legal partners to have left Big Four accounting firms for private practice law firms in Australia in recent months. Big 4 Transaction Services vs.

Unterschied Investmentbanken MA zu Big Four. In this video I discuss what the exit opportunities are for those in the audit as. The bank is the clients bitch Big 4 firm is the banks bitch -2 level 2 7 yr.

They are Deloitte Ernst Young EY PricewaterhouseCoopers PwC and Klynveld Peat Marwick Goerdeler KPMG read more about each below. Although the Big Four are known for providing services to many Fortune 500 individualscompanies they also serve a number of start-ups with high growth potential and small private companies. I have 4 years of MA-related IB advisory at one of the Big 4.

Das machen auch die IB. Known as the Big 4 these firms completely dominate the industry auditing more than 80 percent of all US public companies. MA investment bankers execute the entire deal process from start to finish including finding and contacting potential buyers and sellers marketing the company and negotiating the purchase agreement.

By comparison IB dont tend to have an army of accountants and they usually get fees based on whether company A buys company B so they have incentive to oversell company B. Das machen IBs nicht. Their focus was accountingaudit and consulting they had investment banking and restructuring services but they were an.

Big 4 Firms PwC KPMG EY and Deloitte Partner Salaries. The Big Four accounting firms refer to Deloitte PricewaterhouseCoopers PwC KPMG and Ernst Young. Pre MampA and Post MampAnbsp.

Strides Shasun Sequent Solara Active Pharma Sciences Demerger Cover Inside Pharma Life Science Science

Why The Big Four Accounting Firms Pose A Threat To Big Law Accounting Firms Accounting The Big Four

Stakes Are High As Big Four Push For M A Work Financial Times

Mergers And Acquisitions Powerpoint Template Slidesalad Process Flow Chart Template Process Flow Chart Powerpoint Templates

M A Mergers Acquisitions Strategy Consulting Bcg

Mergers And Acquisitions Ma Process And Steps Merger Life Cycles Knowledge Management

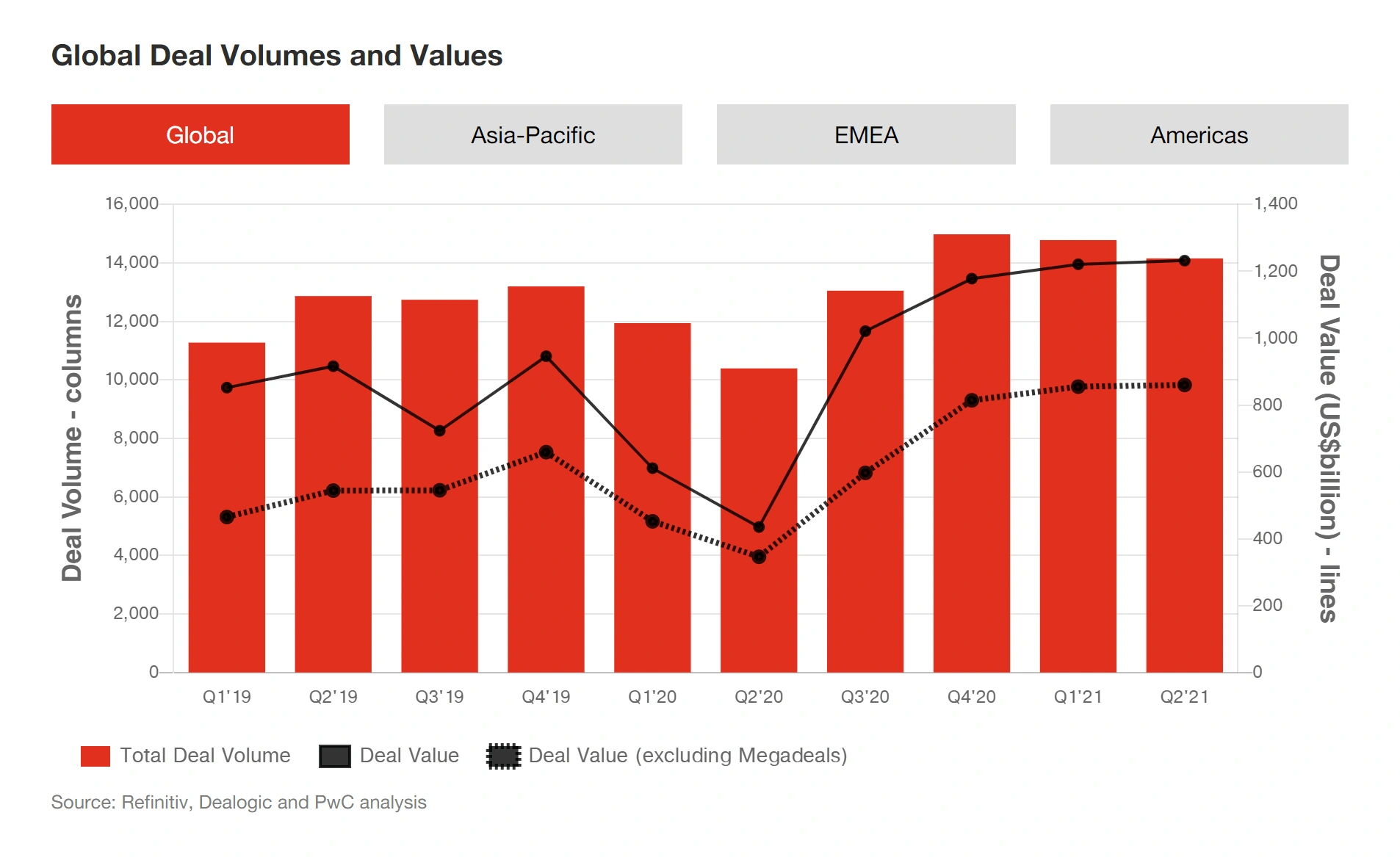

M A In 2020 And Trends For 2021 Morrison Foerster

Gauging Technology Integration Complexity For M A Success Vmware On Vmware Blogs

Global Mergers And Acquisitions M A Deals In 2021 Top Themes In The Travel Tourism Sector Thematic Research

6 Important M A Trends 2022 2024

2021 Was A Blowout Year For M A

Rbi Rejects Proposed Lakshmi Vilas Bank Indiabulls Housing Finance Merger M A Critique Raising Capital Finance Merger

M A In The Consulting Industry Consultancy Org

M A In 2020 And Trends For 2021 Morrison Foerster

M A Transaction Services Deloitte China Finance Advisory

2021 Was A Blowout Year For M A

Martech M A Activity Grew By 95 In 2021

The Ey Cfo Capital Confidence Barometer Features The Views Of 376 Cfos On The Economy Growth Access To Capital M A And More Managing Finances Cfo Finance

0 Response to "big four m&a"

Post a Comment